Guest Post: Diagnostics of Turkey’s Exports at Firm-Level

- Posted by admin

- Posted on January 15, 2015

- Competetiveness

- Comments Off on Guest Post: Diagnostics of Turkey’s Exports at Firm-Level

Along with several other ambitious economic targets, Turkey set a 500 billion USD exports target for the year 2023, the 100th anniversary of the modern Turkish Republic. In policy documents prepared to this end, number of exporters and export destinations are often cited as main dimensions to focus on[1]. However, a cross country comparison reveals that it is the average size of exporters that might be restraining Turkey’s export volume rather than the number of exporters or export destinations.

Utilizing firm-level export data of 10 developed and 35 developing countries, the World Bank’s Exporter Dynamics Database[2] allows us to examine associations between export volume of countries and several components of exports at firm-level.

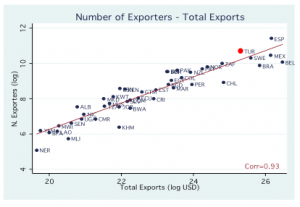

i. Number of Exporters: There is a very strong positive correlation (0.93) between export volume of a country and its number of exporters. Standing well above the regression line in the Figure, Turkey is among those countries having a number of exporters higher than what their export volume correspond.

ii. Average Number of Destinations per Firm (NDF): The correlation between NDF and total export volume of that country is 0.63. With an NDF of almost 4, Turkish firms export to a slightly higher number of destinations than the total export volume of the country implies.

iii. Average Number of Products per Firm (NPF): A Turkish exporter, on average, exports almost 10 different products, defined at HS6 level[3]. As Turkey is well above the regression line, we conclude that there is not a problem with product diversification at firm-level.

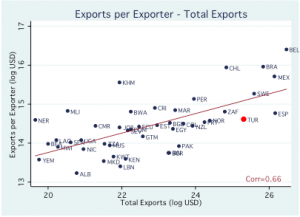

iv. Average Exporter Size: Here comes the dimension in which Turkey underperforms. Size of average Turkish exporter (e.g. average export volume per exporter) is very low relative to total export volume of Turkey.

v. Firm Concentration of Exports: In contrast to the conventional wisdom, concentration of a country’s exports among a small number of large firms (compared to a more equal distribution) does not necessarily have a negative implication for total exports of that country. In fact, we observe a positive, though not very strong, correlation between share of top 1% exporters in total exports and total exports of countries. With a 60% top 1% exporter share, Turkey lags behind its total exports in this measure.

Using a simple methodology, this Note argues that small exporter size in Turkey might be a serious problem preventing the country from exporting more. There are 2 main mechanisms underlying this argument:

1- Sunk costs associated with exporting (such as market research and shipping costs) pose a higher burden for firms exporting smaller amounts.

2- Market power and hence the ability to determine prices and other conditions of trading are lower for smaller transactions.

Unfortunately, increasing exporter size might be a more difficult task for Turkey than it initially looks. This is because not only the average exporter size but also the average firm size (measured by employment or total sales) in Turkey is very low relative to many other countries[4]. This implies that effective export policies should be based on overall structure of the economy and not stand-alone.

[1] See e.g. 2023 Export Strategy and Action Plan, Ministry of Economy of Turkey, 2011.

[2] Available at http://data.worldbank.org/data-catalog/exporter-dynamics-database. Graphs in this Note are based on averages of 2006, 2007 and 2008 stats.

[3] There are around 5,000 products at HS6 level.

[4] See e.g. Good Job in Turkey, available at http://documents.worldbank.org/curated/en/2014/01/18831522/good-jobs-turkey

- March 2023

- February 2023

- September 2022

- April 2022

- February 2021

- June 2020

- March 2020

- December 2019

- November 2019

- June 2019

- May 2019

- March 2019

- February 2019

- October 2018

- August 2017

- June 2017

- February 2016

- October 2015

- May 2015

- March 2015

- January 2015

- December 2014

- September 2014

- April 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- July 2013

- May 2013

- April 2013