Risk Map and Turkey’s Sustainable Development

- Posted by Pelin Dilek

- Posted on February 5, 2016

- Sustainable Development

- Comments Off on Risk Map and Turkey’s Sustainable Development

Turkey’s economic ride throughout 2015 was largely dominated by the direction of the EM flows. As the story of EMs change from high-growth-lower-risk to lower-growth-higher risk story, capital outflowed in net terms for the first time since 2008. EM currencies depreciated in real terms against the USD and financial market volatility increased. The movement of the TL fits well with the EM-wide trend.

Turkey’s performance within the overall EM tide though, has been disappointing. TL is one of the currencies that depreciated the most in 2015, initiated by capital outflows. Volatility indicators were on average one of the highest within the EMs. And this relative negative performance occurred despite the falling oil prices, which helps Turkey’s current account deficit and higher-than-expected growth rates.

This recent graph by TDM summarizes the sentiment against Turkey and a few emerging markets very well. Brazil and Turkey have been worst performers despite one of them being a commodity exporter and the other commodity importer.

Widely accepted reasons for Turkey’s underperformance are domestic developments, especially uncertainties related to the two elections in 2015. Political uncertainty and discussions around the independency of institutions (specifically Central Bank) caused most of the damage.

No Celebration for the Economic Program?

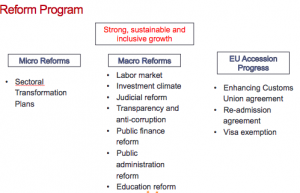

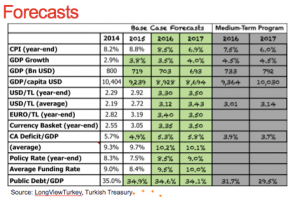

Now that elections are over, a big portion of the domestic-scene related worries should be over; at least in theory. Or they should once after the nomination of a ‘relatively independent’ CBT’s Governor during 1q16. After all, government has recently announced its economic program, which aims to bring about a sustainable, inclusive and high growth rate. In addition to the sectoral transformation programs that had been announced at the end of 2014, there are macro reforms aiming at bringing improvements at the labor market, technology, education and investment climate. Agenda list on EU accession process has been also added to the program. Further more, program has been backed up with an agenda on the to-do-list on various pillars of the program on a 3, 6 and 12-month horizon; just like the days when there was an IMF program between 2002-2007. This is exactly what the markets would love to see back in 2013-14. Many analysts, including this one, wrote repeatedly back then that a serious reform program was what Turkey needed.

Yet, again markets are not buying Turkey story. This time around, the widely accepted view is that reform implementation could be weak, given the existing complex issues that Turkey might need to prioritize, including an early election.

Risk Map Is Changing

Question marks over Turkey’s story are not an issue of prioritization; but the capacity of the policymakers and the flexibility economic program to react to expected and not-so-expected risks. I am not talking about the risks related to the trajectory of FED rate hikes, Chinese economic slow down, the drop in oil prices, double-digit inflation numbers in Turkey, high private sector debt or even possibility of early elections in 2016. Here is my list of risk-related questions, which can have dire consequences on success of the Program and which are also totally out of scope of the financial markets;

- Turkey is in a geopolitical area where social and environmental events are changing the realities of daily life. It is not easy to understand on how 2.5 million refugees are not making any substantial changes on Turkey’s five-year or even three-year economic program. At the very basic level, Turkey’s health and education infrastructure plans would need amendments at a reasonably short-time. Are these part of the current program? CBT recently published a research concluding that the refugee migration has a 2.5% decreasing impact on CPI due to increase in unregistered economy. If the impact of the refugee crisis is mainly going to be through the channel of unregistered economy, can this be one of the reasons as to why GDP growth rates surpass expectations continuously in the last three quarters?

- When most experts link refugee crisis in Syria to climate-related events, it would be realistic to ask whether similar events can impact economic, social and environmental outcomes in some parts of Turkey and whether there are any contingencies related to these risks. Being in the Mediterrian basin, Turkey is identified as one of the countries to be most affected from climate change. The most basic link to be questioned at the shortest-term is the food price volatility related to weather-events. Can the long-waited food market regulation be sufficient to decrease food-price volatility in Turkey or is there a bigger picture that the policy makers need to concentrate on?

- Similarly, are the policy-makers aware of the change Paris Climate Agreement, signed by almost all countries in the world, going to make on world energy markets or at least on energy finance markets? If the energy pillar of the economic program rests on opening of 90 coalmines by 2020 and Paris agreement is going to make the financing of coal mines harder, how will this program be implemented? Are Turkey’s unenthusiastic commitments on reducing carbon emissions submitted at the Paris Conference going to make it harder to have access to energy financing?

- ‘Profound social instability’ sits in the middle of Global Risk Interconnections Map of WEF 2016. It is related to almost all other risks that have a potential to impact global economy. Migration is only one aspect of social instability; public security, confidence levels, drops in investments levels, decreases in transparency are all related to social instability and are likely to effect all economic decisions. What are potential risks of social instabilities outside and inside Turkey to the numbers proposed by the Economic Program?

Financial Market’s Issue vs. Interconnectivity of Real Issues

All of the above questions boil down to governance and institutional capacity with which Turkey will react to the potential market, social, environmental and economic adversities of the coming years. Financial markets are asking the same questions over one issue and actor; i.e. independency of the Central Bank. Given the pace of change in global economy and interconnectivity of risks, looking at economic policy and political developments (in a narrow sense of who wins which elections) or dependency of of CBT to evaluate the outlook of the Turkish economy will not be sufficient any more. The leverage point for the Program and overall Turkey’s macroeconomic performance is the governance capacity of the executive policy makers at the face of not only economic; but also socio-political, environmental, social adversities.

- March 2023

- February 2023

- September 2022

- April 2022

- February 2021

- June 2020

- March 2020

- December 2019

- November 2019

- June 2019

- May 2019

- March 2019

- February 2019

- October 2018

- August 2017

- June 2017

- February 2016

- October 2015

- May 2015

- March 2015

- January 2015

- December 2014

- September 2014

- April 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- July 2013

- May 2013

- April 2013